By Jeff Sanford

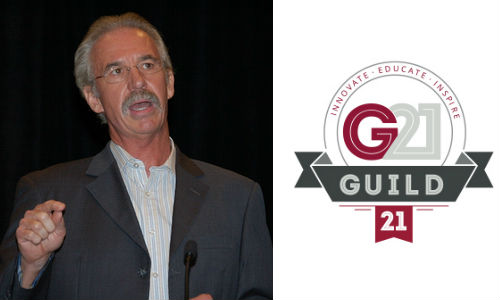

Toronto, Ontario — February 9, 2017 — Anticipation ran high this week concerning an appearance by former insurance executive George Avery on the Guild 21 conference call.

Avery drew on his deep experience on the insurance side of the industry to offer insights on the state of the relationship between collision repair centres and insurance companies in his address, “Direct Repair Programs – Cradle to Grave?”

Avery, of course, is well-known in the collision repair industry for his work representing State Farm to the collision sector. He began his career as a technician and painter before joining State Farm as an estimator and was later responsible for developing and delivering curriculum for estimating personnel and management throughout the company. Beginning in 2005 he also served as a resource for media requests and managed the State Farm Repair Facility Advisory Council. Avery retired from State Farm in June of 2016. He now provides consultant services and is an active participant in the National Auto Body Council (NABC) and Collision Industry Conference (CIC).

In his presentation, Avery talked about the challenges in the relationship between collision repair shops and DRP programs.

He emphasized the need for a collision repair shop to generate a data record about a collision repair shop’s performance. That way, the collision repair shop can back up its claims if there is a dispute. “The method for validating a job can be onerous. Data matters,” said Avery. “Take photos and look at the actual repair. There are always frustrations. Sometimes that masking tape hasn’t been pulled off or a rail isn’t installed right. You don’t have to book everything. But when data is available [there is a record to back up claims],” he said.

Avery also talked about the importance of being familiar with the various procedures expected by the various DRP programs ran by competing insurance companies.

“What is insurer A’s position on panel repair? What’s their position on wheels?,” he asks. “If there is limited or little access to that information it causes a problem. What happens, when, in addition to that limited or no access to that info, exceptions to the rule occur?”

To the credit of the Canadian collision repair sector, Avery mentioned the work of CCIF in this country around the issue of promoting DRP program consistency among insurers.

According to Avery, there are times when the best thing to do is to veer from a stated procedure. Understanding how and why a job exists as an “exception” is only possible when the shop’s techs understand the requirements of the DRP.

“Repairers are really trying to do the right thing. That’s something I understand. Then they get a roof accident. They do the numbers, and they see it’s better for this vehicle to repair and it’s going to take this many hours. But then you get on the phone with the reviewer who says, ‘We don’t spend that much on a panel. We don’t put that many hours on a van.’ But exceptions come along and have to be explained. Delays occur, and it will take extra phone calls [but it happens],” he said.

During the call he posed a question to the crowd: Does your insurer offer shops access to relevant claims information? When the answers (registered digitally) were tallied the lowest percentage answer was, “Yes.” According to Avery, “At most we most have 20 percent saying ‘Yes. They get the relevant information.’

When you’re on a phone and on hold trying to get that information, that’s an example of limited access.”

Clearly, Avery is well-acquainted with the frustrations that collision repair shops have with insurance companies. He noted that another symptom of a problematic relationship between repairers and insurance companies occurs when, “repairers end up confused when insurance staff handle similar cases in a different manner. An even-handed, consistent approach helps on all sides.”

Another point where relationships between insurers and collision repair centres break down is when it comes to the state of communication between shop and insurer.

“This can be a case of insurance companies not inspecting repair facilities. Training, the equipment, the size of a shop … that can be gathered on a checklist. Sometimes it seems that when it comes to physical inspections, we can live without them. A physical inspection by a knowledgeable agent is expensive and takes time,” said Avery, noting that they’re still necessary. “The symptoms of not looking at a repair facility emerge over time.”

Avery noted that when one shop in a program begins to fall behind the others, the entire network begins to suffer. “Claims representatives can lose faith in the DRP plan. Repairers get frustrated when a less-qualified shop is still on a program. That’s a symptom of repair facilities not being inspected originally and on an ongoing basis,” he says.

Avery explained the intent behind the creation of DRPs. “They were developed to increase the efficiency of the claims department, but also to reduce claims staff. As a result, things that can happen can include less and less communication. The relationship can become so hands off that there is a problem. That ratchets down the health of a DRP environment. It reduces the oxygen available to the shop,” said Avery.

He warned shop owners to make sure their insurer has an advisory council staffed with people from the industry “Not having an advisory council representing both sides can lead to a lack of information,” he said.

Avery also noted it was important that insurance companies have an, “… active industry spokesperson … someone who participates in industry events. You can’t help but gather important on-the-ground information. I’ve had people share concerns, sometimes too loudly to be understood … but if you just listen, you just might find they have a point,” he said.

If communication and understanding between the insurer and the industry have lagged, real problems rapidly emerge.

“Another real symptom of lack of information is that the gap a lack of information creates will be filled by rumours,” he says. “When there is a lack of information, someone will fill the gap. And that gets rapidly out of hand in an era of social media, which can get rolling with misinformation. Most of that could be avoided if there was better communication.”

Overall, according to Avery, proper procedures and methodologies have to be adhered to. “The reality is that there is limited or no physical re-inspection after the repair is completed. The insurer has an obligation to check and validate repair costs. And those need to be checked before the vehicle goes out of the door. But insurance companies can’t re-inspect every vehicle, and so that’s why programs are subject to review and the methodologies are in place. The insurers, in some cases, are frustrated in some cases if they have to go look at repairs. The customer doesn’t want to be disturbed again” says Avery. But this is why inspections and communication are necessary between the industry and the insurers.

“The symptom of not looking at repairs is that, eventually, claims from clients about repairs not being done right begin to rise,” he said. “The whole idea of looking at vehicles after they are repaired, with no physical inspections after repair, can hurt DRP programs,” said Avery. “This is the grave question in the market … the potential stall of DRP efficiency.”

Avery also noted that it’s his belief that, “… insurers put unintended pressure on repairers simply by having different programs.” That is, each company has its own preferred procedure. “The issue here is that more and more is required of the repairer, both in terms of responsiveness and complexity of repair,” he said. There are consequences to this approach. “Repairers wait for insurance companies to develop programs and then they tailor their procedures to that … it’s like the shop is trying to catch different balls, with a glove on one hand and a tennis racquet in the other. One insurer sends a baseball over, another lobs a tennis ball. And then they volley back and forth, but these differences cause trouble. Something I would like to see to take a couple steps forward on this, is to see some general DRP guidelines adopted across the entire industry,” he said.